Where does your city rank?

Sherpa's latest city rankings by active drivers in each city

Back by popular demand, the latest city rankings as of November 1st. You can see there's been quite a bit of movement outside of the Big Three - Los Angeles, San Francisco, and San Diego. For example, Austin's up to #4.

We want to have Sherpa help every single on-demand driver and deliverer. Tell your friends not to be left behind!

Free Sherpa account / "Where does your city rank?"

Trouble viewing on mobile? Rotate phone

city metrics, city rankings, sherpa, drivers, lyft, uber, sidecar

Wow! Sidecar drivers earn 20% more per mile.

And why you should care.

We ran the numbers: Across Sherpa's nearly 1 million trips, Sidecar drivers earn on average $3.29 per mile. Compare this to Uber's $2.95 and Lyft's $2.40 per mile national averages, the two companies who continue to fiercely compete on price. That's about 20% higher earnings per mile.

Marketplace feature = More driver control

The reason for this is simple: Sidecar’s marketplace model, where drivers set their own prices, allows drivers to be competitive based on the car they have, their reviews, or demand fluctuations throughout the day. Rather then competing on a race-to-the-bottom lowering of rates, savvy Sidecar drivers can add a multiplier to the regular base fare. In short, it's a DIY-surge pricing, although not solely based on demand.

Going a mile further in San Francisco

We took a closer look at what this trend is like in a few individual cities, including San Francisco. Sidecar's per mile earnings advantage in SF is around $0.40 higher, or 15%.

In SF that means on a day where a driver’s earnings goal is $200, a rideshare driver would need to drive 10 more miles with passengers on Lyft to make the same amount as a Sidecar driver. Typically, that's grabbing at least two more fares.

But I only care about earnings per hour!

OK, that's definitely valid. In fact, this is what Uber and Lyft both seem to be optimizing for: Increasing 'marketplace liquidity' to keep the driver busier with lower prices but ultimately higher per hour income. See the below back-of-the-napkin sketch tweeted by Yammer founder David Sacks, simplifying Uber's approach.

Keeping busy means that you're working harder (extra stress?) and putting more miles on your car. Sure, your hourly rate may be higher, but your driving quality may not be as high, and you'll certainly be headed to the gas pump and service station more frequently.

Let's say I did want to optimize for value.

Well if you're following this, that means you're making the most net earnings per mile on Sidecar. When you set your own rates in a marketplace, you may at times be less busy than your Lyft and Uber counterparts, however you'll have the satisfaction of knowing you're getting more value out of your trusty car. That said, if you are in Baltimore and are lucky enough to get a 9x surge ride from Uber, you may just end up $362 richer after 20 minutes!

If you're a serious driver anyway, you're likely running at least two apps already, studying surge pricing patterns, and sorting all of this out on Sherpa.

Here's an experiment you can try: While waiting for a ping in Sidecar, find a cozy parking spot, put it in park, and read the news on your phone or catch up on a phone call. Save your precious miles for a passenger, and earn a bit more.

earnings per mile, sidecar, lyft, uber

Guest Post: "Do Lyft and Uber Drivers Pay Taxes?"

Sherpa contributor, data guru, and author of RideshareDashboard.com recently shared a great overview of making estimated tax payments as a driver. We hope you find this useful. Next up: Sherpa will be sharing its own tax guide 'how-to' for Sherpa drivers actively using the Sherpa Dashboard. Stay tuned.

Do Lyft and Uber Drivers Pay Taxes?

October 23, 2014 by The Rideshare Dashboard

As a self employed employee, you are responsible for your own taxes. Lyft and Uber pays you your full wage and its up to the driver to pay their own taxes.

The Internal Revenue Service (IRS) requires you to make quarterly estimated tax payments for calendar year 2014 if both of the following apply:

- you expect to owe at least $1,000 in federal tax for 2014, after subtracting federal tax withholding and credits, and

- you expect federal withholding and credits to be less than the smaller of: 90% of the tax to be shown on your 2014 federal tax return, or

- 100% of the tax shown on your 2013 federal tax return (only applies if your 2013 tax return covered 12 months – otherwise refer to 90% rule above only).

Some people may not be required to pay estimated taxes as this year they are paying 100% of the tax shown last year.

When do I need to pay Estimated Taxes?

Here is are some quick calculations to estimate when you will need to pay estimated taxes:

Without deductions, a tax payer in the 25% marginal tax rate will have a total tax rate of about 40% when you include in the 15% self employment tax (made up of social security and medicare)

With a 40% tax rate, if you made over $4000 take home from Uber or Lyft after their commission, you will need to pay estimated taxes.

Figuring for deductions, my marginal tax rate is only 25% when I deduct about 1/3 of my income due to the standard mileage deduction of 56 cents a mile.

With a more realistic 25% total tax rate, if you made over $5000 take home from Uber or Lyft after their commission, you will need to pay estimated taxes.

The above figures are gross estimates and does not apply to every driver. If you are unsure how to make these calculations, speak with your local licensed tax preparer.

Estimated taxes need to be paid quarterly or there is a small penalty at the end of the year. Below are the payment dates for each quarter:

PAYMENT PERIOD DUE DATE

- January 1 – March 31, 2014 April 15, 2014

- April 1 – May 31, 2014 June 16, 2014

- June 1 – August 31, 2014 September 15, 2014

- September 1 – December 31, 2014 January 15, 2015*

How do I make federal quarterly estimated payments?

rideshare dashboard, taxes, independent contractor, quarterly taxes

Are you double dipping driving services yet?

We've noticed a common path drivers take within the on-demand workforce. The path toward double-dipping, aka being active on multiple services at the same time.

You’ve likely noticed the trend yourself. You start with one service, and a few months down the line, you’re active on multiple services, running them at the same time, and have a different work pattern then when you started. And you're hopefully making more money as a result.

Of course the trend is different for everyone, but we’ve noticed some major stages. Today we wanted to share our observations based on Sherpa data and driver conversations. In addition, we’ve highlighted one of our drivers, who is now quadruple-dipping services.

This path most closely applies to the on-demand driving and delivery companies (which by no coincidence are the companies we’re currently supporting), including Lyft*, Uber*, Sidecar*, Summon, Postmates*, DoorDash*, SpoonRocket, Fluc*, Sprig, and others. (*currently supported on Sherpa)

The journey: A path toward increased income?

For drivers, it’s not simply a on-boarding with services because of curiosity (although that’s part of it). Beyond the earliest stages, the journey for most of the drivers we’ve talked to has been a path toward increased income. That’s their goal at least.

The question for them: What’s the best path to head there?

What’s so exciting for us at Sherpa is that this on-demand workforce lifecycle is just beginning. These are super early days for companies that are just a few years old with a fast growing independent contractor base.

The paths people take will be vastly different. Particularly for drivers, it’s unfolded like this:

Discovery: Income from an app anytime I want? Yes, please. Count me in.

You first hear about the service, through a friend, and it seems to good to be true. Your car qualifies, you pass a phone screening and a background check, do the brief training, and you’re on your way.

Routine: The earnings are looking good, and the work routine is down.

You’ve set yourself a good part or full time schedule. You’ve got your work pattern: Evenings, weekends, rush hours. And as the pay statements roll in you feel good about this work and empowered about having so much control of your income stream.

Questioning: Perhaps I should start thinking more strategically about this?

You realize that your spending a lot of time on this work and you haven’t actually thought strategically about your net income: Am I making as much as I need to? A few hundred sounds good, but can I be doing better? Especially after a few slow nights. You think it would be a good idea to expand your options in the future.

Tipping point: You'll pay me to try out your service? Of course!

The tipping point comes with the sign up bonus, or the realization that you can double-dip, and make more. And you hear that others are doing this and managing quite well. You on-board with new services (maybe grab some quick referral cash). Now you’re hitting the road armed with multiple apps. You’ve just doubled, tripled, or quadrupled you efficiency…

One drivers path through Lyft, Uber, Sidecar…

In June, Jason on-boarded with Lyft. In July, he added Uber and Sidecar. A triple dip.

Jason’s discovery to working for Lyft was quite natural: He’d already been involved in the transportation and driving space, and saw Lyft as a flexible complement to his salaried driving job. Jason typically picked up weekends and evenings to work.

Then the routine set it for Lyft, with decent hourly rates and earnings per trip. For example, Jason was average about $15/trip for Lyft in July and August.

The questioning and tipping point came around the same time, thanks to $500 sign up bonus from Uber and promises of higher hourly rates. And Jason added Sidecar to complete his triple-dip.

It turns out his Uber earnings we’re not as lucrative as he’d hoped. Jason’s earnings per trip** were only $8.75 on Uber, compared to around $15 on Lyft. (**earnings per hour we’re not complete across all included services). Sidecar’s earnings per trip for Jason? Around $8 per trip.

And then Postmates.

In September another tipping point for Jason: Postmates was doing a big growth push with promises of great earnings. There was grumbling about Lyft being less busy, so another option seemed important. So, Jason joined the Postmates team, and added another service to his on demand resume.

While it’s still early days for him on the Postmates front, it’s been a competitive gig for him. Most recently, both Postmates and Lyft have the same average earnings per trip for him: $12.

And the best part is Jason’s still active on all four services! At a moment’s notice, Jason could quadruple dip: turn on all 4 apps and wait for that first ping. Or simply choose the optimal times to work on each one.

The point is, the semi-maturity of Jason’s journey is now based on maximizing available work options and strategy. The path beyond: More efficient work, new services, his own driving company?…

Are you double-dipping services? What stages did we miss out on? Tell us about your path.

Join Sherpa for free | Share on Facebook

Earn $50 on sign up for Lyft | Join the Sidecar driving team

lyft, uber, sidecar, postmates, double dip

Now Supporting Postmates

One more step closer to your complete income analytics

We're excited at Sherpa to support Postmates now! As a Postmates driver you can integrate your earnings with Sherpa. It's easy to do! Go ahead and sign up. Or if you've already created a Sherpa account, here are the instructions

Want to be the first to tell this to your driving friends? Share on Facebook

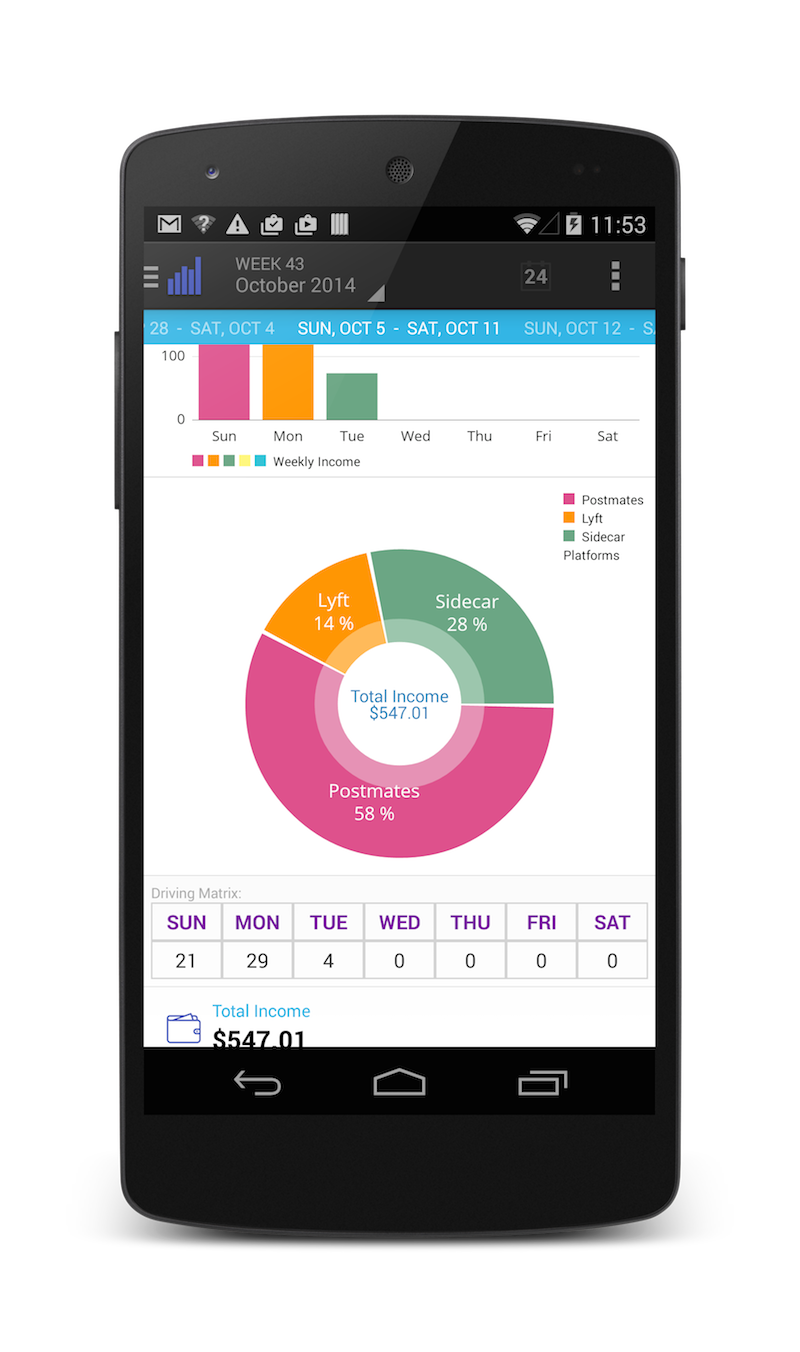

Now, you can view platform specific earning on our dashboard and our Android app.

Postmates, deliverers

Article: Uber is slowly dimming the lights on drivers. Will this last?

Published by Ryder Pearce

Uber is dimming the lights on the precious information drivers have available to them. As of this past weekend, Uber is no longer allowing drivers the ability to download their earning statements.

This is huge. Drivers are losing confidence in Uber and looking for other options. Earnings information is fundamental to drivers as independent contractors.

Forget pricing and policy changes. Sure, those have major impacts on drivers as well. But before, at least drivers could run their numbers to see how pricing and policy changes have affected them. This is no longer an option.

Read the rest on Medium (3 minute read).Share with Drivers

Uber is slowly dimming the lights on drivers. Will this last?uber, driver, earnings, independent contractors

Announcing our partnership with FLUC

A great delivery option, and a free lunch for drivers!

We're thrilled to announce our partnership with FLUC - the Food Lovers United Co - and their driver "Free Lunch" program!

That's right! We said free lunch upon sign up! FLUC is an online marketplace that's connecting restaurants, drivers and consumers to change the way we eat and think about food.

As a driver for FLUC you can earn up to $25 per hour, get ongoing driver lunch and loyalty programs, and much more! FLUC is growing quickly throughout the Bay Area, and is looking for drivers to become part of the dream. Join today!

And for existing Sherpa users, you'll eventually have access to FLUC earnings and expenses right on your Sherpa Dashboard!

To sign up with this fast-growing delivery company, and get free lunch, click here to apply. Be sure to select SherpaShare when selecting "Where did you hear about FLUC?"

fluc, sherpa, partnership, free lunch, analytics, independent contractors

Introducing Sherpa on Android

The wait is over.

Our Android app is ready! Download HERE.

It supports Android devices with OS 4.1 and up. Currently, it allows you to access all your high level metrics by day, week and month. You can easily navigate to different days and weeks by swiping to the left or right.

In addition to the easy to view Dashboard, you can also view your expenses and latest news on the go. It's the early beta version, so we'd love to hear your thoughts!

Don't have Android? Stay tuned. In the meantime, web-based Sherpa has made some improvements!This includes further site Documentation and a great guide on Getting Started.

New to Sherpa? Create your free account.

Sherpa, Android App, Dashboard

Most popular Lyft, Uber, Sidecar cities using Sherpa

Ranked by Active Sherpa Drivers

The biggest trends: Los Angeles (1st) and San Francisco (2nd) far and away on top 2; Chicago (4th) making a move toward San Diego (3rd); Virginia Beach (5th) still punching above its weight, ahead of Phoenix (6th), Dallas (7th), and Boston (9th).

Fastest growth since September? Austin (8th) has quickly moved up from 19th; Seattle (12th) has moved up from 23rd; and Washington DC (18th) has moved up from 28th. Big shout out to Omaha for joining the list this week too

Is your city moving up or falling behind relative to others? Find your city below.