Announcing Your Estimated Tax & Tax Savings

We've added Tax Estimation to your Dashboard

We've rolled out a beta tax estimation feature and are looking for your feedback! This is now live on your Dashboard. You'll see both your estimated tax and tax write-off numbers, based on your taxable income. Go ahead and see how it looks.

What does this mean for me using Sherpa? Now when you add in your mileage or gas expenses you'll see your estimated tax write-off number increase. When you're logged into Sherpa you can add any extra mileage or expenses you've tracked under the "Reports & Analytics" section, and watch your estimated tax-write off update.

For a step-by-step guide on how to add mileage and update your tax write-off on Sherpa, scroll down or click here

New to Sherpa? Create you free account and see your driving income and cost analytics within a few minutes.

Here's how to add in your mileage:

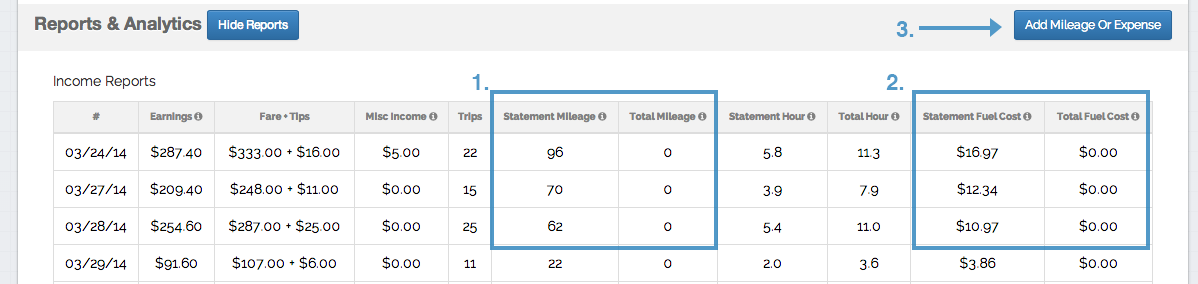

One: Your total mileage is found next to reported mileage (from Lyft/Uber/Sidecar passenger miles) in the "Reports & Analytics" section

Two: Your fuel cost is next to reported fuel cost, which is estimated from reported mileage.

Three: Ok, so to add in your mileage and costs here click "Add Mileage or Expense"

Four: Enter the total mileage you tracked when "on-duty" here. This will update the "Tax Write-Off" total at the top

Five: Enter any gas receipts you tracked for mileage. Currently, this does not affect the "Tax Write-Off" total at the top.

Then click "Report & Refresh" button at bottom of this section

Six: Notice the "Estimated Tax Write-Off" increase! Feel free to go ahead and add any past mileage you've logged.

rideshare, taxes, tax, income, costs, lyft, uber, sidecar

Also read: Fresh Tax Savings Tips for Freelancers...